Mapping Two Decades of China’s Industrial Policies

What are the economic and political forces that shape the content and effectiveness of China’s industrial policies?

INSIGHTS

Analysis of nearly all public industrial policy documents in China from 2000 to 2022 reveals a complex and adaptive system shaped by both local initiative and political hierarchy.

China’s local governments have driven most industrial policy in China (80% of policies), but top-down influence has strengthened since 2013, reflecting growing central influence over local policy priorities.

The central government (13% of all industrial policies) mainly plays an agenda-setting role, prioritizing strategic sectors and using regulatory tools (40% of central policies).

Cities tend to support industries where they enjoy local advantages (e.g., existing specialization), especially in more developed regions with stronger administrative capacity.

Policy tools evolve as industries mature, shifting from entry subsidies and land discounts to R&D, labor training, and supply chain coordination.

Policy imitation is common and costly — “follower” cities see lower firm revenues, profits, and productivity, and are less likely to use advanced tools like R&D support or tailor policies to local conditions.

Industrial policy is most effective when locally tailored and well coordinated, but risks inefficiency and duplication when driven by imitation or political incentives.

Source Publication: Hanming Fang, Ming Li, and Guangli Lu (2025). Decoding China’s Industrial Policies. National Bureau of Economic Research (NBER) working paper.

China uses a wide range of industrial policies at the national and subnational levels to guide economic development. These include financial tools like subsidies and tax breaks, efforts to support business entry and improve regulations, investments in infrastructure, land, and worker training, and measures to boost demand through government purchasing or consumer incentives. Some policies also aim to strengthen local supply chains by encouraging firms in related industries to cluster together. How do China’s central and local governments design, target, and implement industrial policies — and what are the economic and political forces that shape their content and effectiveness?

The data. With the help of large language models (LLMs), the researchers analyze the near universe of publicly released government policy documents (3 million documents) between 2000 and 2022 across the central, provincial, and city levels in China. The researchers then identify and classify more than 768,000 industrial policy documents. These policies are coded by “tone” (e.g., supportive, regulatory, suppressive), policy objective, targeted industry, policy tools used (e.g., subsidies, R&D support, land discounts), and implementation features (e.g., performance targets or pilot programs). The authors link this policy data to firm-level administrative records, including tax filings, registration data, and financing outcomes. The analysis uses statistical estimations and exploits variation across time, sectors, cities, and political turnover to uncover the drivers and impacts of industrial policy targeting and designs.

China’s industrial policy is much more than just subsidies. The researchers define industrial policy as any government document that aims to influence the long-term structure of the economy by targeting industries with specific policy tools. The analysis finds that China uses a wide range of tools to carry out its industrial policies, and different levels of government emphasize different approaches. The most common tool is fiscal subsidies, included in 41% of all policies (a single industrial policy document often includes multiple tools). Other widely used tools include market access and regulation policies (e.g., licensing or foreign investment rules; 35%), support for technology R&D and adoption (24%), labor policy (e.g., wage subsidies; 22%), and tax incentives (20%). The central government leans heavily on regulation and market access (42% of its policies), while city governments (of which there are about 330 in China) rely more on subsidies (48%), labor support (27%), and infrastructure investment (23%) to attract and support local business. Notably, supply chain tools, such as promoting industrial clusters and other localization policies (e.g., mandates to source from local suppliers), have seen their usage nearly double from around 10% to 20% over the past two decades. These findings suggest that analyses relying solely on subsidy data significantly underestimate both the scale and sophistication of China’s industrial policy regime.

Evolution of industrial policies

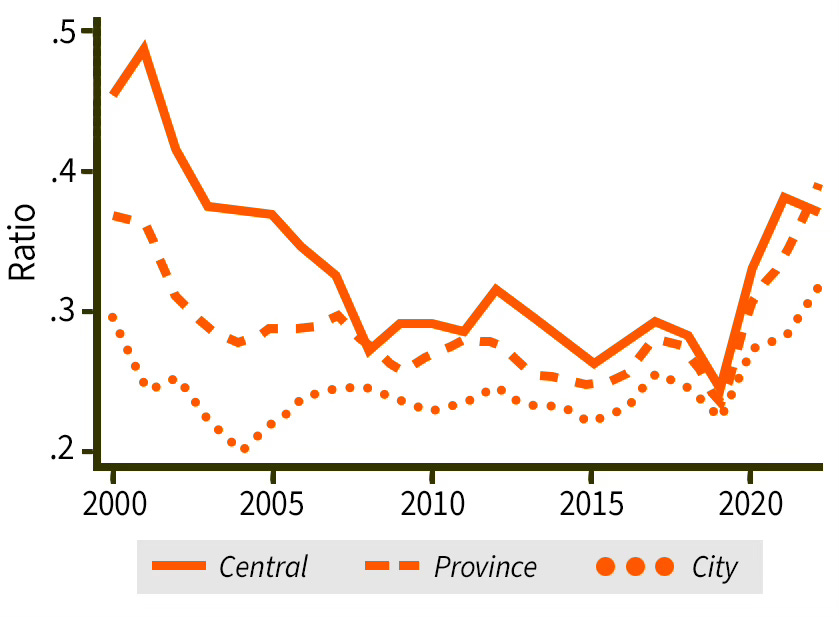

The bulk of China’s industrial policymaking occurs at the subnational level. Of the 768,000 industrial policy documents analyzed, just 13% were issued by the central government, compared to 45% by provincial governments and 39% by city-level governments. Local governments also relied more heavily on direct firm support tools. For instance, fiscal subsidies appear in 48% of city-level policies, compared to 25% at the central level; labor policies are used in 27% of city-level policies versus 16% centrally; infrastructure investment shows a similar local skew (23% versus 11%). The analysis suggests this difference reflects both the discretionary power of local governments to experiment and their incentives to compete for investment, employment, and political recognition. In China’s government promotion system, local officials are evaluated partly on economic performance metrics — such as investment, industrial upgrading, and fiscal revenue — making successful industrial policy a potential stepping stone to career advancement. In contrast, the central government plays a more strategic and regulatory role, emphasizing tools like market access and regulation (42%) and trade protection (19%), and focusing policy attention on strategic industries (20%). The central government sets broad priorities and enforces alignment through top-down directives as reflected in policy citation networks.

Proportion of industrial policies, by government level

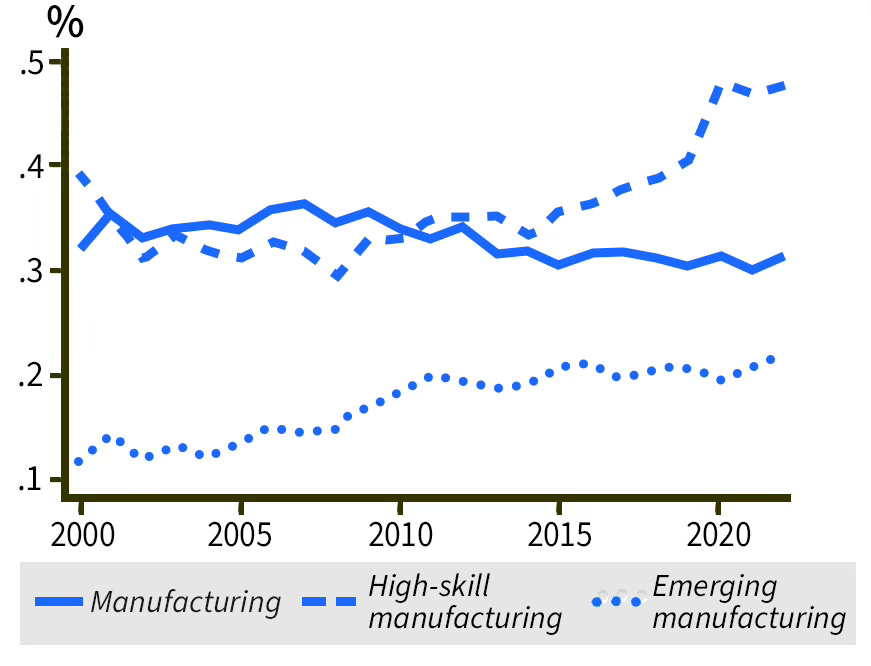

Targeted industries: manufacturing takes center stage, but there is regional heterogeneity. China’s industrial policies focus heavily on manufacturing and related services. Manufacturing is the target of 29% of all central and local policies, and production-related services (e.g., wholesale, information and technology, finance, etc.) are the target of 40% of central and local policies. The central government emphasizes manufacturing even more, with 35% of its policies focused on manufacturing. Service sectors also are a major focus: 20% of all policies target tech-related services, 18% focus on high-skill services (e.g., engineering and technical support), and 29% on lifestyle services (e.g., retail, tourism, childcare). Agriculture still receives substantial attention, mentioned in 17% of all industrial policies. Within manufacturing, policies aimed at high-skill and emerging manufacturing are growing over time, reflecting an increasing emphasis on technical upgrades and innovation. Agricultural policies are more common in less developed inland areas, especially in north and west China. Manufacturing policies are concentrated in major industrial provinces like Guangdong, Zhejiang, Shanxi, and Jiangsu. High-skill and emerging manufacturing are mostly targeted in wealthier coastal and eastern regions.

Target industries within the manufacturing sector over time

Industrial policy choices shaped by local advantage, top-down hierarchy, and government career incentives. The analysis finds that China’s city governments tend to support industries where they already have an edge — either because they are unusually strong relative to other cities or simply large and well-established locally. But the analysis shows these choices are not made in isolation. Cities often follow the lead of higher-level governments, especially their provincial authorities. This top-down influence is stronger in less developed cities (measured by local GDP per capita), where local officials have weaker political ties to superiors (i.e., shared hometowns, schools, or work history), and where there is greater competition for promotions (more peer cities within a province). Since 2013, this hierarchical alignment has grown significantly stronger, reflecting a broader political recentralization. As a result, industrial policy choices today are shaped as much by political incentives and institutional structure as they are by local economic fundamentals.

Industrial policy instruments evolve with the maturity of the targeted industry. In the early phases of an industry, local governments focus on promoting tools that lower entry barriers, such as fiscal subsidies, preferential land supply, market access reforms, and entrepreneurship promotion. As industries mature, the emphasis of policies tends to shift more toward R&D, labor and skills development, supply chain coordination, and consumer-side demand stimulation (e.g., subsidies, trade fairs, procurement contracts with local businesses). The same pattern holds for implementation strategy: strict top-down enforcement (e.g., mandates) gives way to performance-based incentives, support for government departments to work together, and institutional support (e.g., streamlining administrative processes, government staff training). These dynamics reveal a state apparatus capable of adjusting its industrial policy toolkit based on the developmental stage of targeted sectors.

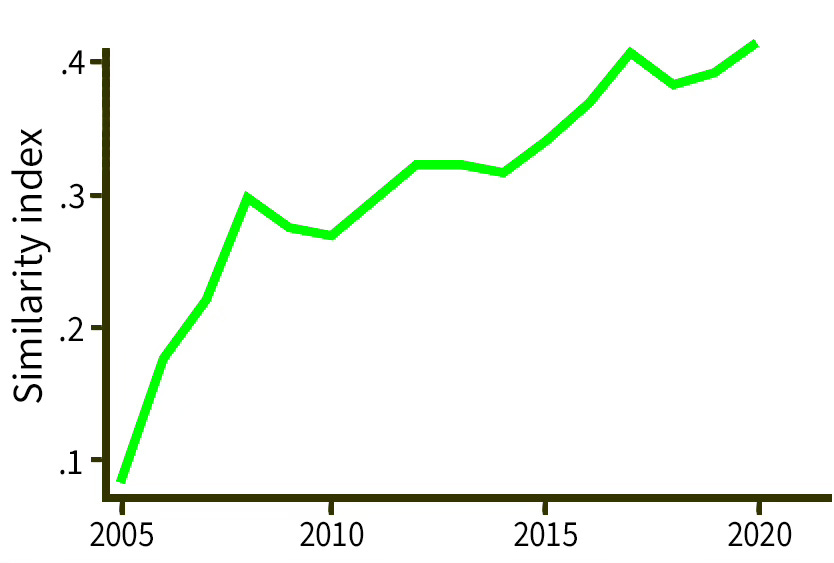

When every city wants the same industry: the risks of imitation and local protectionism. The analysis shows that cities in China often adopt similar industrial policies — especially cities within the same province — leading to duplication, inefficient competition, and overcapacity. This policy overlap is linked to growing local protectionism where firms increasingly trade with other local firms, rather than across city lines. A major driver is intense regional competition, as local governments vie for key supply chain industries to boost tax revenue, jobs, and political standing.

Industrial policy similarity between cities in the same province

Because officials are evaluated relative to nearby peers, they often prioritize retaining local firms over national efficiency. As a result, the analysis finds that “follower” cities that imitate early adopters often see weaker outcomes: they attract smaller, less productive firms, and their firms in the targeted industries show lower revenues and profits. These follower cities also use less advanced policy tools (like R&D and coordination support), and are less likely to tailor policies to local strengths. This imitation-protectionism cycle undermines regional specialization and cross-city coordination.

Industrial policies boost firm subsidies, credit, and entry — but only certain tools improve productivity. To evaluate whether China’s industrial policies deliver real benefits, the researchers used firm-level tax data to track changes before and after policies targeted specific industries. Supportive policies led to clear financial gains: firms receive 6% more subsidies and 5.3 percentage points higher tax deduction rates and are 2.3 percentage points more likely to secure long-term loans. Policies also spurred new firm entry, especially when tools like subsidies, land discounts, or labor support were used. However, tools like trade protection, R&D grants, and government procurement had little or even negative effects on entry — likely because they raised barriers or favored incumbents. Productivity effects were mixed: R&D support, equity investment, and cluster development improved productivity, while tools that encouraged broad entry were linked to declines in productivity, likely due to attracting lower-performing firms.

Industrial policy works best with high local capacity and coordination — but risks duplication, protectionism, and overcapacity. The findings highlight that industrial policy in China is not a monolithic, centrally planned strategy, but a complex and adaptive system shaped by both local initiative and political hierarchy. Its findings suggest that while industrial policy can successfully direct resources to targeted sectors, boost firm entry, and deliver real financial support, its effectiveness depends heavily on the local government’s capacity to choose appropriate tools and adapt over time. At the same time, the study raises important concerns about increased policy similarity and overcapacity, warning that poorly coordinated or politically motivated local policies can lead to inefficiencies and duplication.